2024. 05. 09.

C‑657/22. – SC Bitulpetrolium Serv SRL | Citing administrative shortcomings, an additional excise duty cannot be imposed if it does not correspond to the actual use […]

2024. 05. 09.

C‑509/22. – Girelli Alcool Srl | In the case of using excise goods under customs control, the destruction or irreparable damage due to the negligence of […]

2024. 04. 22.

C‑316/22. – GABEL Industria and Co. | Consumers cannot be prevented from directly claiming back unlawfully charged excise duty from the Member State. The plaintiffs in […]

2024. 04. 22.

C‑122/23. – „Legafact” EOOD | The judgement in case “Legafact” might be instructive for Member States applying revenue thresholds for VAT registration. The European Court of […]

2024. 03. 25.

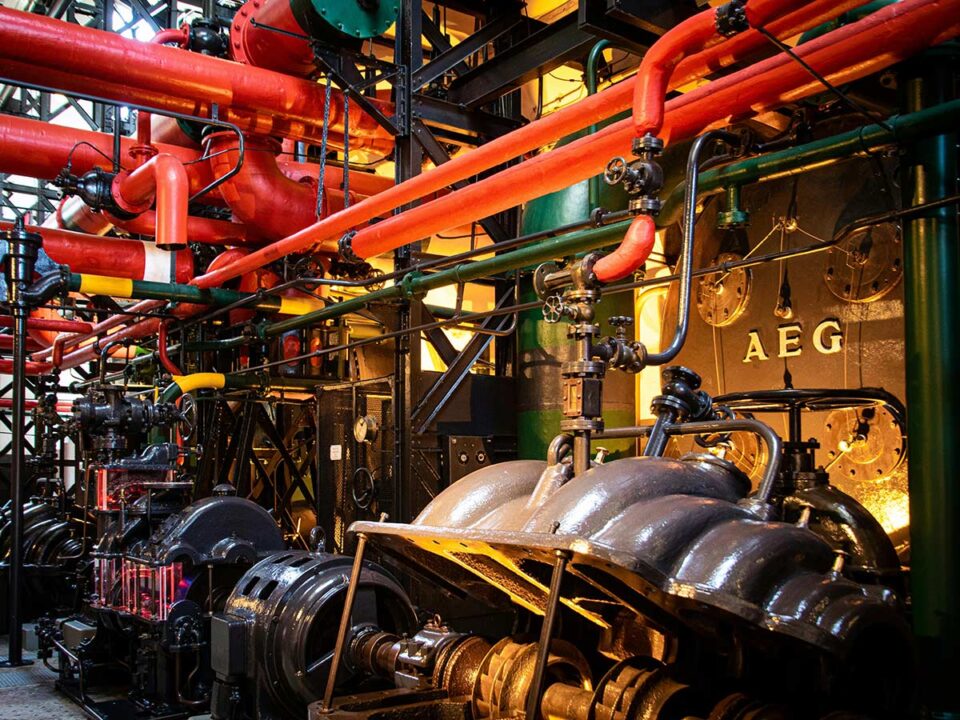

C‑336/22. – f6 Cigarettenfabrik GmbH & Co. KG | The German supplementary excise duty imposed on heated tobacco is in line with EU law. The plaintiff […]

2024. 03. 25.

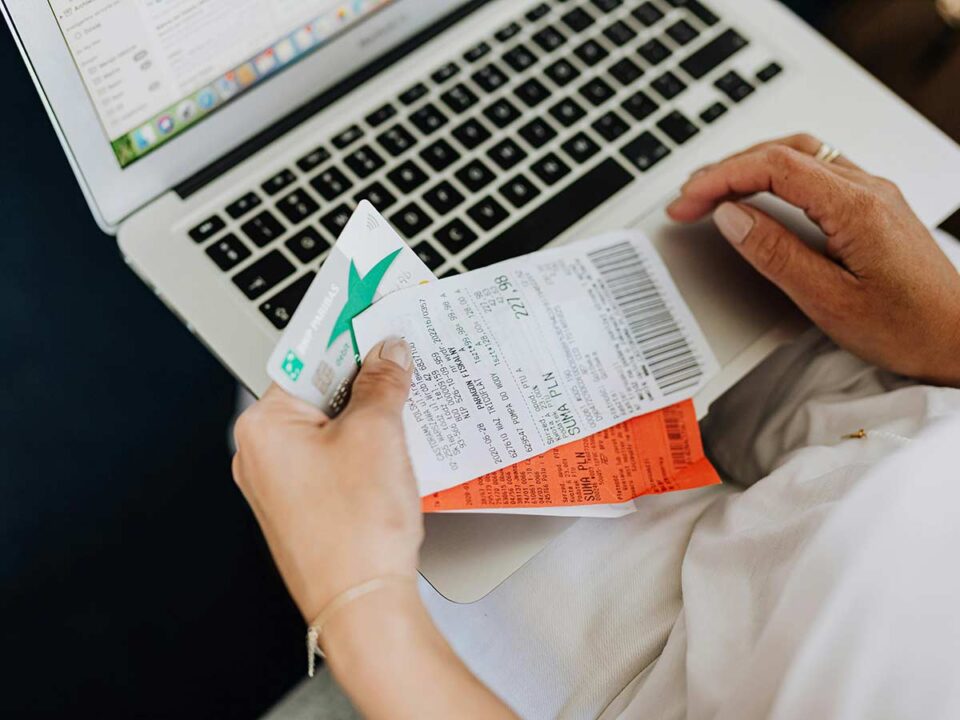

C‑606/22. – B. sp. z o.o. | In case of sales documented by a receipt, incorrectly charged VAT can also be reclaimed if it has not […]

2024. 03. 13.

C‑341/22. – Feudi di San Gregorio Aziende Agricole SpA | The VAT Directive precludes national regulation that ties the taxable person status to reaching a certain income threshold […]

2024. 03. 10.

C 676/22. – B2 Energy. s r.o. | During the examination of the VAT-exemption related to intra-Community supply of goods, the tax authority must take into […]

2024. 03. 01.

C‑314/22. – „Consortium Remi Group” AD | The European Court has delivered another judgment regarding the value-added tax on unpaid consideration The plaintiff in the underlying […]

2024. 02. 26.

Case C-674/22 – Gemeente Dinkelland | As long as the tax authority is not in delay with the reimbursement, the municipality is not entitled to late […]

2024. 02. 26.

Case C-694/22 – Commission vs Malta | The European Court found that the Maltese motor vehicle tax violates EU law. The European Court examined the regulation […]

2024. 02. 20.

C‑442/22. – P sp. z o.o. | If an employee issues a fake invoice on behalf of the employer, the employer can only be obliged to […]

2024. 02. 14.

C‑733/22. – Valentina Heights EOOD | The reduced VAT rate related to accommodation services may not depend on the existence of a certification in the category. […]

2024. 01. 28.

C‑791/22. – G. A. | Even for goods illegally imported, the import VAT must be levied in the Member State where the goods have entered into […]

2024. 01. 17.

C‑96/22. – CIDL | It is in accordance with the EU law if a national regulation restricts the year-end “strategic” stockpiling of cigarettes through quantitative limits. […]