News, analyses, publications

T‑643/24. – Cristian General Serv SRL The CJEU’s recently published judgment provides another instructive example that payment obligations of a “penalty” nature may also form part of the VAT taxable amount where they are linked to a service that has been supplied and received. In a hotel located [...]

At the beginning of January 2026, the OECD published a document in connection with the global minimum tax introducing the so-called “Side-by-Side” system. The document sets out a political and technical agreement on the parallel and complementary operation of the global minimum tax and domestic tax systems. In [...]

The Ministry for National Economy has issued two new decrees setting out detailed implementing rules for the application of exemptions under the global minimum tax (Pillar Two), as well as for the related registration, filing and payment obligations in Hungary. The Hungarian Official Gazette dated 19 December 2025 [...]

The Working Days in Hungary 2026 calendar provides a clear and practical overview of monthly working days, working hours and public holidays applicable in Hungary. This calendar is particularly useful for: employers and HR professionals, payroll and accounting teams, international companies operating in Hungary, workforce planning and annual [...]

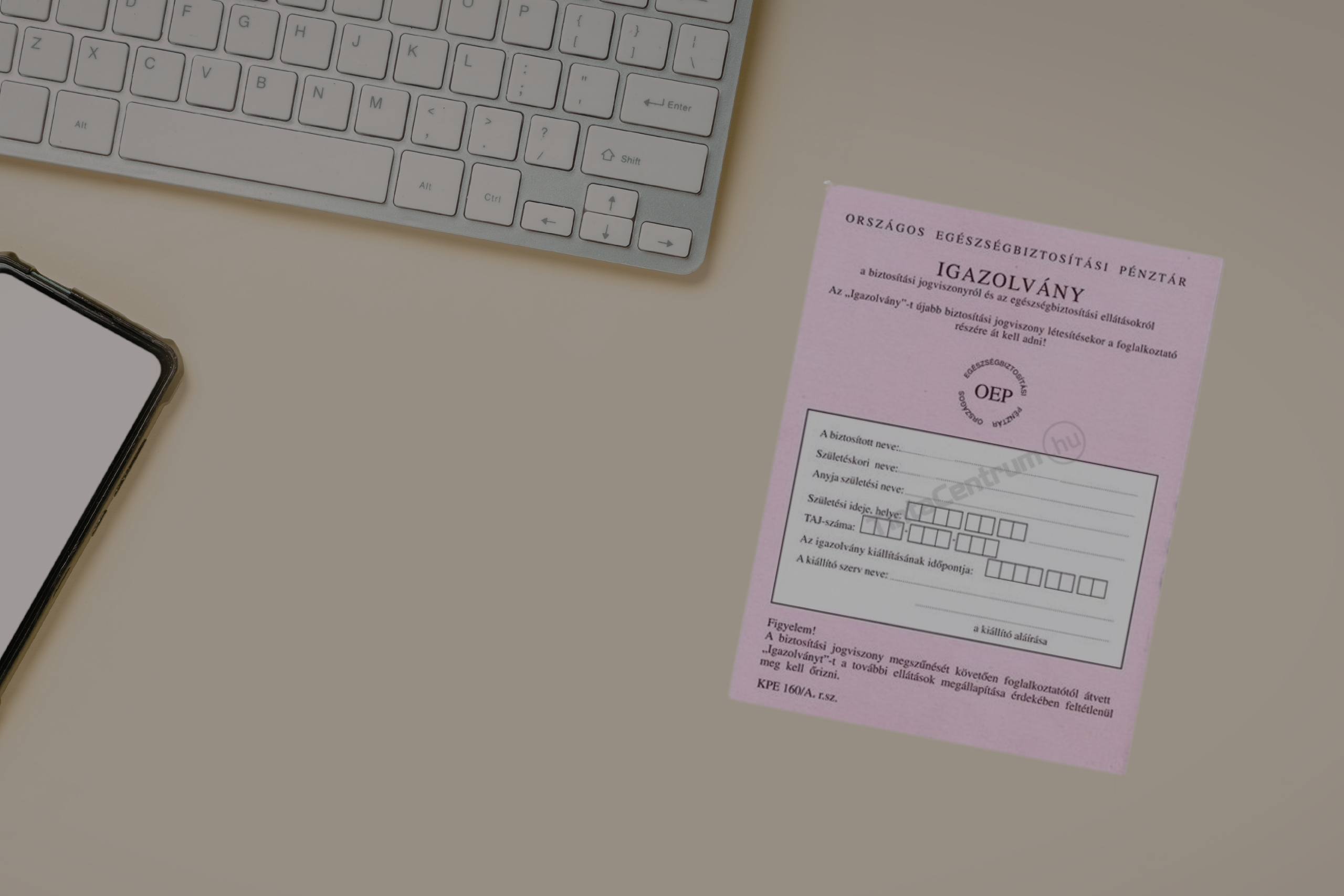

As of 1 January 2026, a significant change will take effect in the Hungarian social security system: the paper-based social security booklet (TB kiskönyv) will be discontinued and replaced by a new electronic system, the so-called e-Social Security Booklet (e-TB kiskönyv). The objective of this change is to reduce administrative burden and ensure faster and [...]

Numerous articles have heralded and described the new transfer pricing regulation that will come into force in 2026. It is not our intention to join this chorus, but rather to emphasize the importance of documenting all related-party transactions for the 2025 tax year and complying with data reporting [...]

At the beginning of the year, we would like to provide you with a comprehensive and detailed overview of the HR and payroll obligations affecting 2026, with particular focus on working schedules as well as declaration requirements related to tax allowances. The detailed list of public holidays, rest [...]

The 2026 working calendar in Hungary includes several long weekends and three transferred working days, making early planning essential for both employers and employees. The overview below summarizes public holidays, rest days and transferred working days, along with key HR and payroll considerations. 1. Public holidays and rest [...]

In the 19 November 2025 issue of the Hungarian Gazette, a comprehensive omnibus act (Act LXXXIII of 2025) was published containing part of the year-end tax package. Two days later, an additional set of tax amendments was released in the form of a second omnibus act (Act LXXXIV [...]

T 646/24 – MS KLJUČAROVCI, d.o.o. Under the EU VAT system, the conditions for applying the triangular simplification may also be met in four-party chain transactions where the goods are actually delivered to the domestic customer of the third party in the chain (Party “C”), in the Member [...]

C‑234/24. – Brose Prievidza, spol. s r.o. As a general rule, an intra-Community supply or acquisition of goods presupposes that the goods are physically dispatched or transported from one Member State to another. This requirement applies even where the ownership of a tool used in the production process [...]

C 744/23. – Zlakov A consideration subject to VAT also arises where a court awards a fee to a legal aid provider who has acted free of charge in the proceedings, provided that the party represented is successful. In the case at hand, a Bulgarian law firm provided [...]