The Discontinuation of the Paper-Based Social Security Booklet – What Does This Mean in Practice?

As of 1 January 2026, a significant change will take effect in the Hungarian social security system: the paper-based social security booklet (TB kiskönyv) will be discontinued and replaced by a new electronic system, the so-called e-Social Security Booklet (e-TB kiskönyv).

The objective of this change is to reduce administrative burden and ensure faster and more secure access to data.

What Was the Social Security Booklet Until Now?

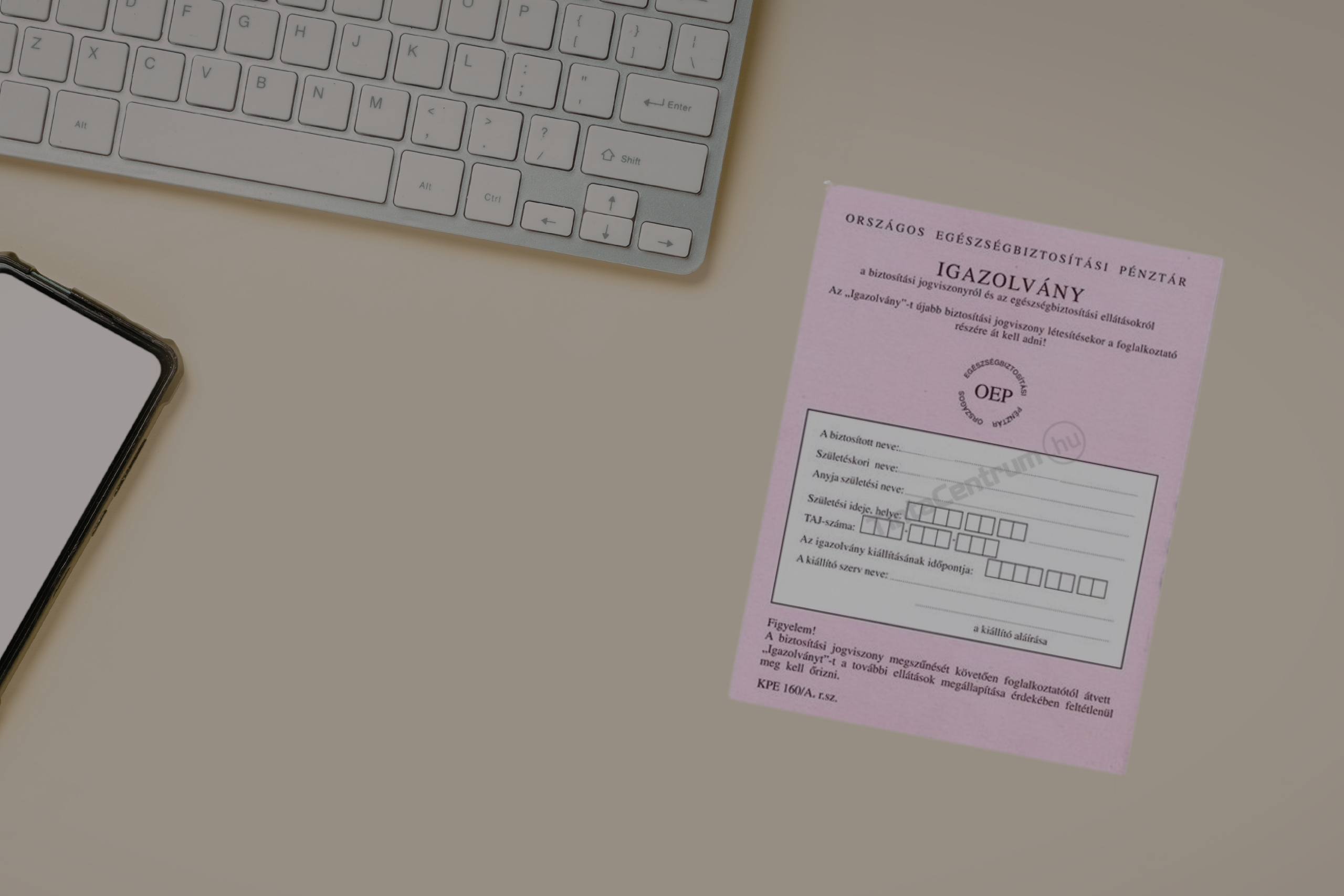

The social security booklet was a paper-based document in which employers recorded an employee’s insurance relationships and certain health insurance cash benefits.

Maintaining this booklet represented a significant administrative burden for both employers and employees.

What Will Change from 2026?

As of 1 January 2026:

- Paper-based social security booklets will no longer be issued.

- Data related to insurance relationships and cash health insurance benefits will be available electronically in a central system.

- The name of the new system is the e-Social Security Booklet (e-TB kiskönyv).

- In the case of social security paying agents, employers and payroll providers will be able to access, via the e-TB booklet system, the employee’s historical data required for determining health insurance benefits, which were previously recorded in the paper-based booklet.

- In the case of employers that do not operate as social security paying agents, the Hungarian State Treasury (MÁK) will maintain the e-TB booklet based on T1041 forms submitted to the Hungarian Tax Authority (NAV).

What Must Be Done with the Old Paper-Based Social Security Booklet?

- The employer is required to return the paper-based social security booklet to the employee, at the latest upon termination of employment.

- The employee must retain the booklet for 5 years after reaching retirement age.

- If the employer is unable to hand it over, the employer must retain the booklet until the same deadline.

Where Will the Data Be Available?

Employees will be able to review:

- via the NEAK online interface, and

- through the magyarorszag.hu portal

their insurance history and, from 2026 onwards, data related to sick pay, CSED, GYED, and other cash benefits.

What Happens in Case of Data Discrepancies?

If an employee notices that a previous insurance relationship is not reflected in the electronic system, they may initiate a document-based evidentiary procedure with the competent government office based on their place of residence.

What Does This Mean for Employers?

- For employers without a social security paying agent, once the paper-based booklet has been handed over, no further administrative obligation arises.

- Employers operating a social security paying agent will have query access to the e-TB booklet system, limited exclusively to employees currently employed by them.

Summary

The introduction of the e-Social Security Booklet is a clear step toward digitalisation, which:

- reduces paper-based administration,

- increases transparency of insurance relationships, and

- in the long term, results in simpler and more efficient administration for both employees and employers.

Sources:

Lépjen kapcsolatba szakembereinkkel!

Az alábbi űrlap segítségével feliratkozhat szakmai hírlevelünkre, így folyamatosan értesítjük az adózás, a könyvelés és a bérszámfejtés területén megjelenő újdonságokról.